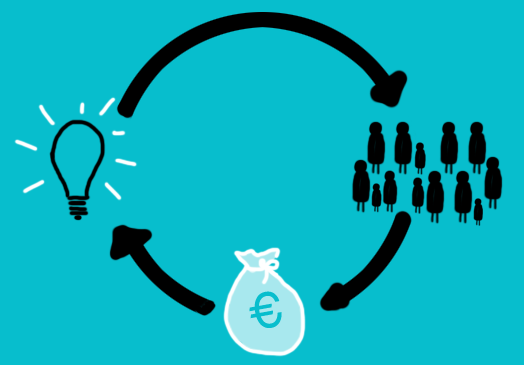

We all know crowdfunding is a popular way of raising funds for startups and good causes, but Nesta is reporting that those willing to fund innovations in return for equity have increased a staggering 410 per cent in the last two years.

We all know crowdfunding is a popular way of raising funds for startups and good causes, but Nesta is reporting that those willing to fund innovations in return for equity have increased a staggering 410 per cent in the last two years.

Those who would prefer to get something in return, such as an early sample of the product have been responsible for a 210 per cent growth over the last two years and P2P consumer lending has risen 108 per cent.

People sharing the cost burden of community projects has increased by 95 per cent and businesses that are willing to lend to other businesses has grown by 250 per cent.

Additionally, awareness around crowdfunding has risen, with 58 per cent of the people surveyed having an awareness of what alternative finance (including crowdfunding, donations, community shares and debt-based securities).

The report reveals that £73,222 is the average amount borrowed when it comes to crowdlending from businesses, although it’s a lot lower – £5471 – when it comes to consumers lending to businesses.

The average amount equity crowdfunding raises is £199,095, which is the largest amount per company, apart from debt-based securities that only accounts for £4.4m total revenues, with the average company receiving £730,000.

In terms of the companies receiving the funding, the research has revealed that 70 per cent of small businesses borrowers using P2P business lending have seen their turnover grow since secured funding with 63 per cent of them recording a growth in profit.

For the smaller projects, funded by alternative finance including reward systems, social is playing an important part and those that have a good social following are reaping the rewards.

Interestingly, ten per cent of all UK consumers have used an alternative funding model of some sort over the last two years, showing it certainly has changed the way the general public is thinking about financing things they feel passionate about.